Documentation

API Reference

Overview

The Juni Payment API is organized around REST. Our API accepts form-encoded request bodies, returns JSON-encoded responses, and uses standard HTTP response codes and authentication. We provide APIs and other services to enable you initiate collection, disbursement and remitance transactions.

Authentication

You will make use of the Client ID, Secret, Token Link and generated tokens to authenticate all your requests to the Junipay API. The Client ID, Secret and Token Link and be found in your dashboard where you can also manage your private public key pair.

Tokens are generated for API endpoint requests by using your private key while tokens for

Payment Form integration

is generated by making a request to your Token Link. Your Secret and Client ID have to be passed

in this request. Tokens have to be passed in the

Authorization header parameter. Any request made to an API endpoint, or Payment

Form integration without a token will receive a 401: Unauthorised response.

The Authorization header parameter should be passed in the format below.

Authorization: Bearer [TOKEN]

All API requests must be made over HTTPS. Calls made over plain HTTP will fail. API requests without a valid authorization header parameter will also fail.

Secure your Secret Key and Private Key

Do not commit your secret and private keys to git, or use them in client-side code.

Errors

Junipay's API is RESTful and therefore, it uses conventional HTTP response codes to indicate the success or failure of requests.

| Code | Description |

|---|---|

| 200, 201 |

Request was successful and intended action was carried out. Note that we will always send a 200 if a charge or verify request was made. Do check the data object to know how the charge went (i.e. successful or failed). |

| 400 |

A validation or client side error occurred and the request was not fulfilled. |

| 401 |

The request was not authorized. This can be triggered by passing an invalid secret key in the authorization header or the lack of one |

| 404 | Request could not be fulfilled as the request resource does not exist. |

| 500, 501, 502, 503, 504 |

Request could not be fulfilled due to an error on Junipay's end. This

shouldn't happen so please report as soon as you encounter any instance of this. |

Base URL

https://api.junipayments.com

Bank Codes

This is the list of Banks JuniPay integrates with and the codes to use for each bank

| Code | Bank |

|---|---|

| 2001 | Access Bank |

| 2003 | Agricultural Development Bank Limited |

| 2004 | ARB Apex Bank Limited |

| 2005 | Bank of Africa |

| 2006 | Bank of Ghana |

| 2002 | Absa Bank |

| 2007 | CalBank PLC |

| 2008 | Consolidated Bank Ghana Limited |

| 2009 | Ecobank Ghana Limited |

| 2010 | Fidelity Bank Ghana Limited |

| 2011 | First Atlantic Bank Limited |

| 2012 | First National Bank (Ghana) Limited |

| 2013 | GCB Bank Limited |

| 2014 | Guaranty Trust Bank (Ghana) Limited |

| 2015 | National Investment Bank Limited |

| 2016 | Prudential Bank Limited |

| 2017 | Republic Bank (Ghana) PLC |

| 2018 | Stanbic Bank Ghana Limited |

| 2019 | Standard Chartered Bank (Ghana) Limited |

| 2020 | OmniBSIC Bank |

| 2021 | United Bank of Africa |

| 2022 | Universal Merchant Bank Limited |

| 2023 | Zenith Bank (Ghana) Limited |

| 2024 | First Bank of Nigeria |

| 2025 | Societe Generale Ghana |

Collections

Junipay offers three different ways to receive collections from customers: Payment Link, Payment Form and Payment API endpoint.

Personalized Payment Link

Prerequisites

- You must be verified by going through compliance and get approved.

The Junipay Payment Link guides customers to a customized form after which users provide their account and other details such as thier emails and other details you specify on your Junipay Dashboard. This link can be sent to your payee through social media apps like Whatsapp and can be placed on buiness pages on Instagram and Twiter.

Your Payment Link will be: https://junipayments.com/

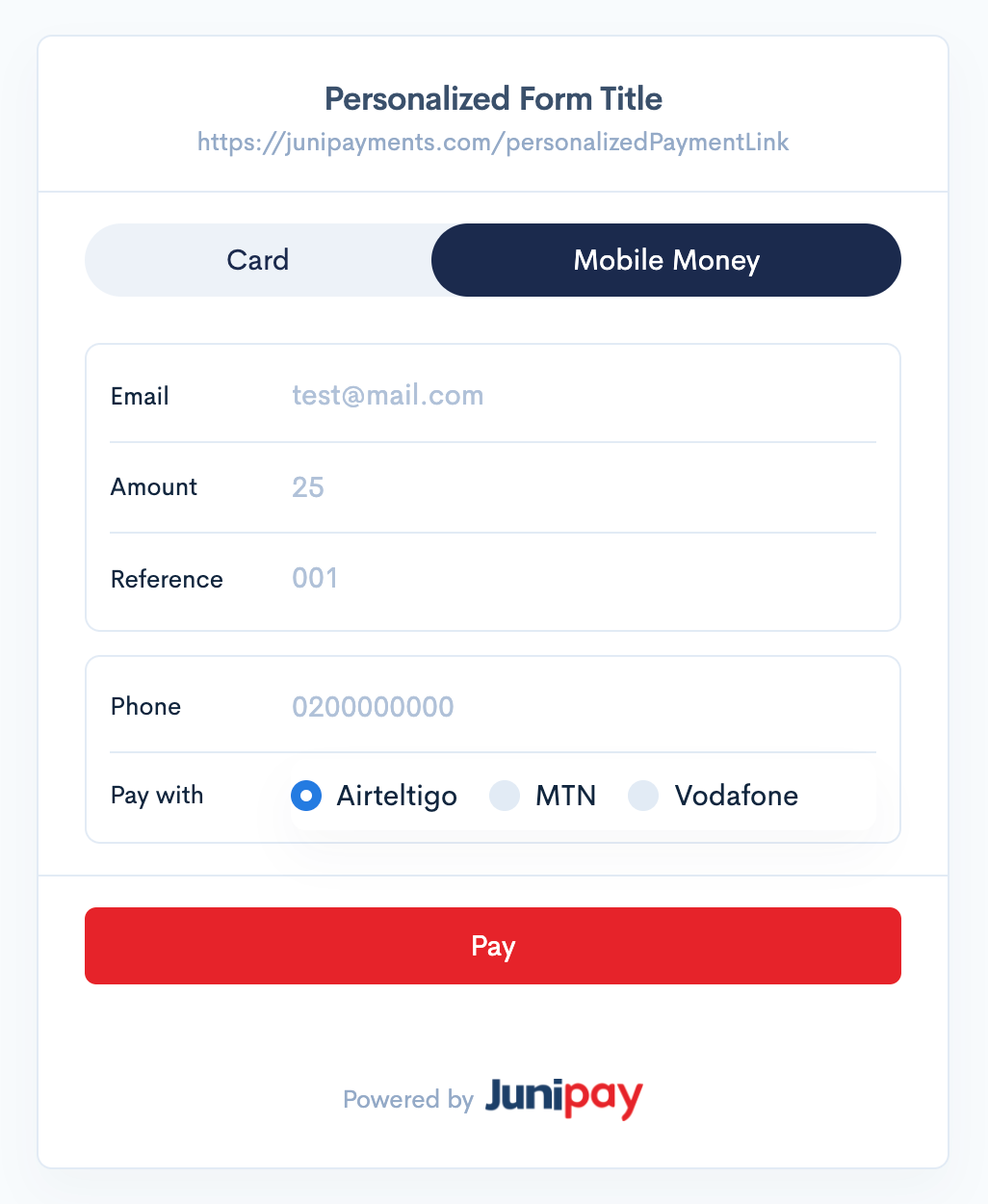

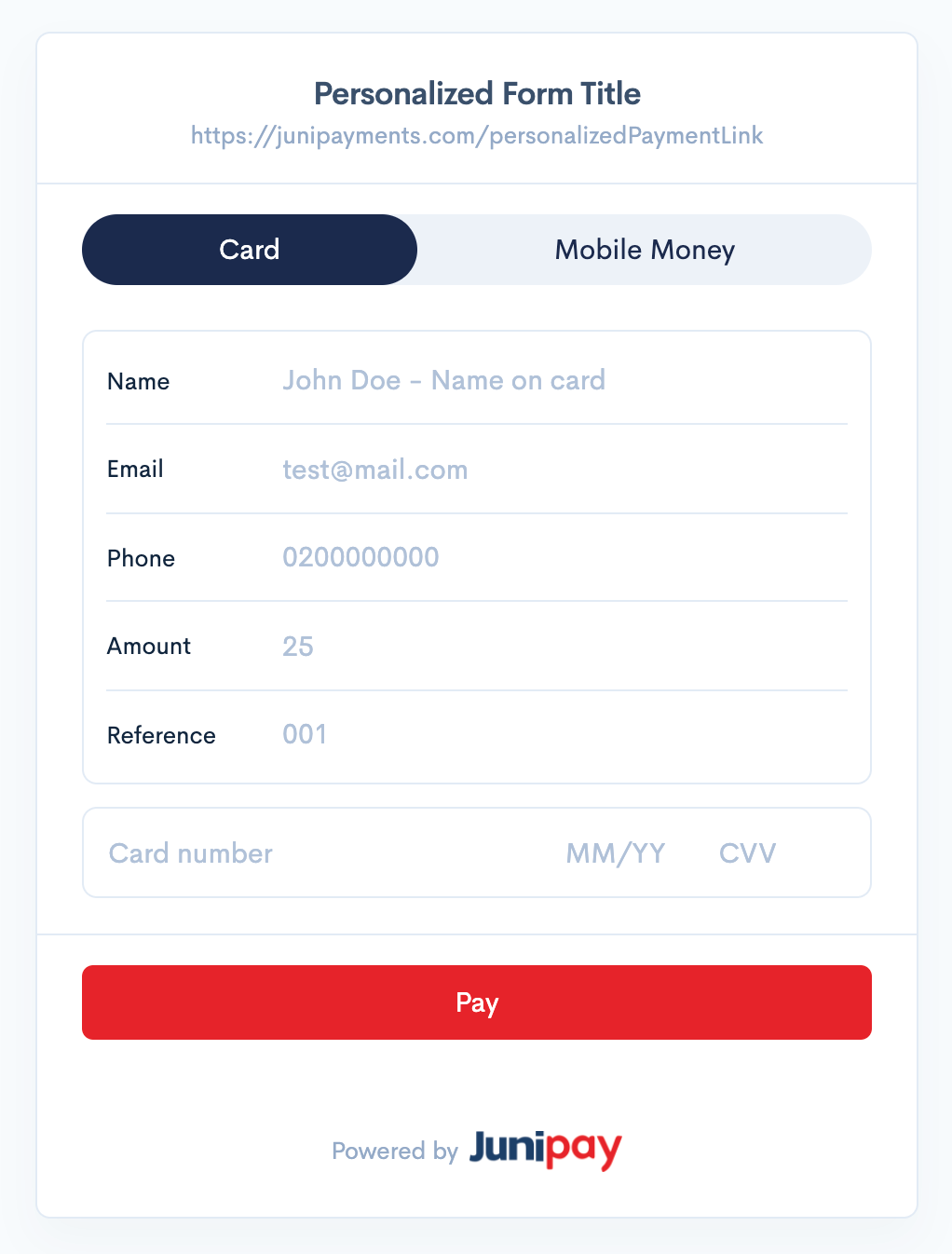

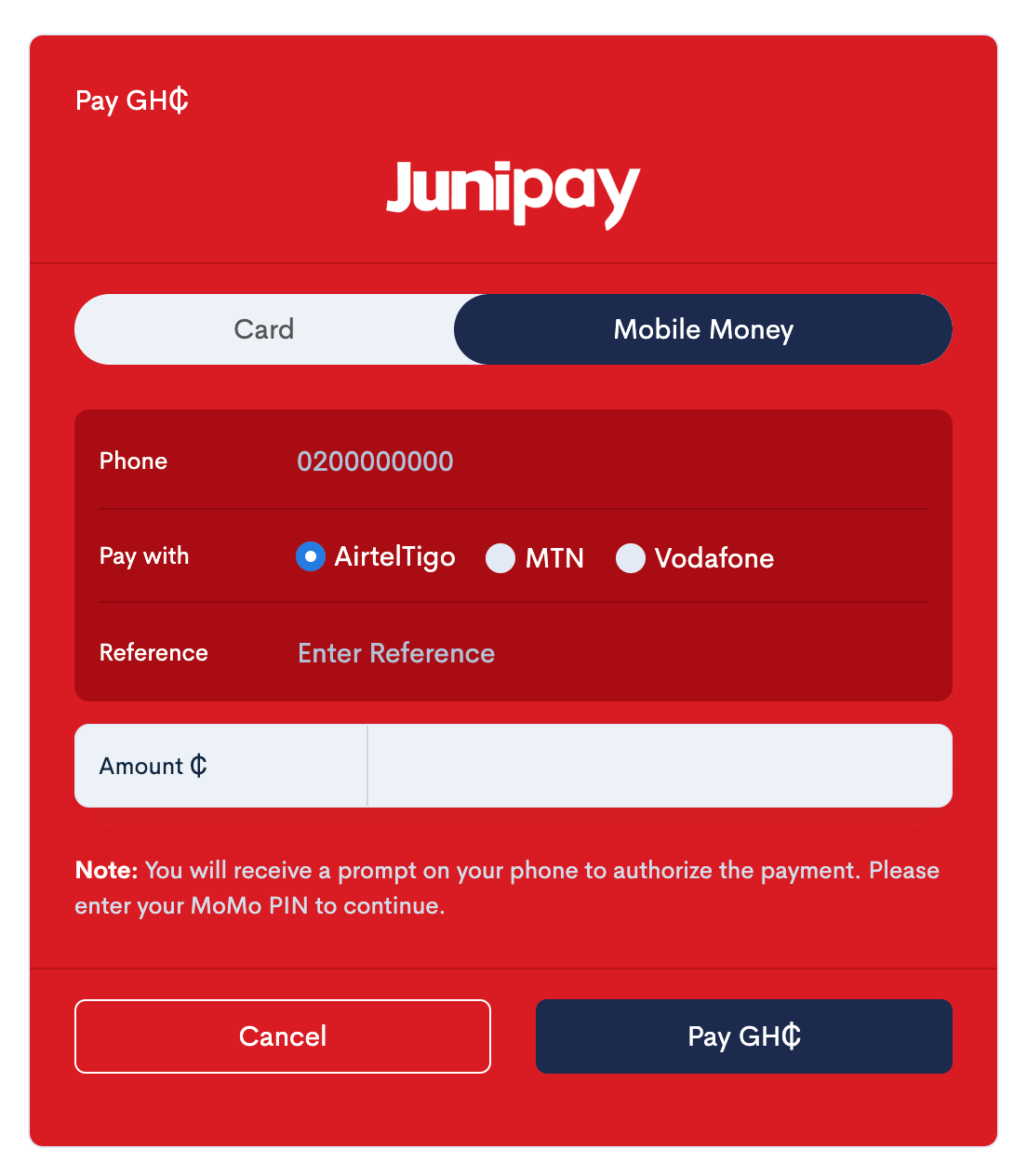

Payment Link Form - Mobile Money

Payment Link Form - Card

Payment Form

Prerequisites

- You must be verified by going through compliance and get approved.

- Your Client ID, Secret key, and Token Generation Link which are located in the Getting Started page on your Dashboard.

- JQuery will need to be imported into the webpage for the Payment Form integration to work

The Junipayment Form provides a simple and convenient payment flow for web. It can be integrated in easy steps, making it one of the easiest way to start accepting payments. See demo of the payment method here:

Test it out now:

To initialize the collection transaction, you will need to pass the customer's email, customer's phone number, transaction amount and the generated token. Email, phone number, amount and token are required.

Integration Steps

The payment form can be integrated in 5 easy steps;

- Import the inline.js file into your web page.

- Generate JWT (JSON Web Token) with your secret and token link.

- Copy and paste the payWithJunipay() function to your webpage. Then update attributes as needed and assign the generated token to the key attribute in the setup object.

- Assign the payWithJunipay() function to the button you want to trigger the payment form with.

- Start receiving money from customers.

<script src="https://api.junipayments.com/js/inline.js"></script>

curl --location --request GET 'https://api.junipayments.com/obtaintoken/{unique_id}' \

--header 'Content-Type: application/json' \

--header 'xderd: {secret}'

var request = require("request");

var options = { method: 'GET',

url: 'https://api.junipayments.com/obtaintoken/{unique_id}',

headers:

{

'cache-control': 'no-cache',

xderd: '{secret}' } };

request(options, function (error, response, body) {

if (error) throw new Error(error);

console.log(body);

});

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/obtaintoken/{unique_id}');

$request->setMethod(HTTP_METH_GET);

$request->setHeaders(array(

'cache-control' => 'no-cache',

'xderd' => '{secret}'

));

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

// Code snippet to call the default payment form

function payWithJunipay() {

var handler = JuniPop.setup({

key: {token}, //put your token here

clientid: {client ID},

email: 'customer@email.com', //put your customer's email here

amount: 1, //amount the customer is supposed to pay

color: "white",

desc: "payment for service",

total_amt: 1,

foreignID:"2384374323484",

customer_token: {customer_id} //eg. RCP_607ee694abc0c67c32822d54,

callbackUrl: 'https://yoururl/callbackUrl',

redirectUrl: 'https://yoururl/redirectUrl',

onClose: function() {

alert('Transaction cancelled');

}

});

}

// Default way of using the default payment form from Junipayments. your Button must have onclick function payWithJuni. example onclick="payWithJunipay();"

<button onclick="payWithJunipay();">Pay Now</button>Options

| Paramter | Type | Description |

|---|---|---|

| key | String | Token generated using your secret key |

| clientid | String | Your client ID |

| String | Email address of customer | |

| amount | Double | Amount debiting customer. |

| color | String | Background color of payment form. |

| desc | String | Description of item/service being paid for. |

| total_amnt | Double | Total amount to be paid (for multiple products). |

| customer_token | String | ID of customer who has made payment before |

| onClose | Callback | Javascript function that is called if the customer closes the payment window instead of making a payment. |

| foreignID | String | Optional, Unique string that will be used to query a specific transaction |

| callbackUrl | String | URL the callback request will be sent to

Must be of method |

| redirectUrl | String | The url payers will be redirected to after payment is made |

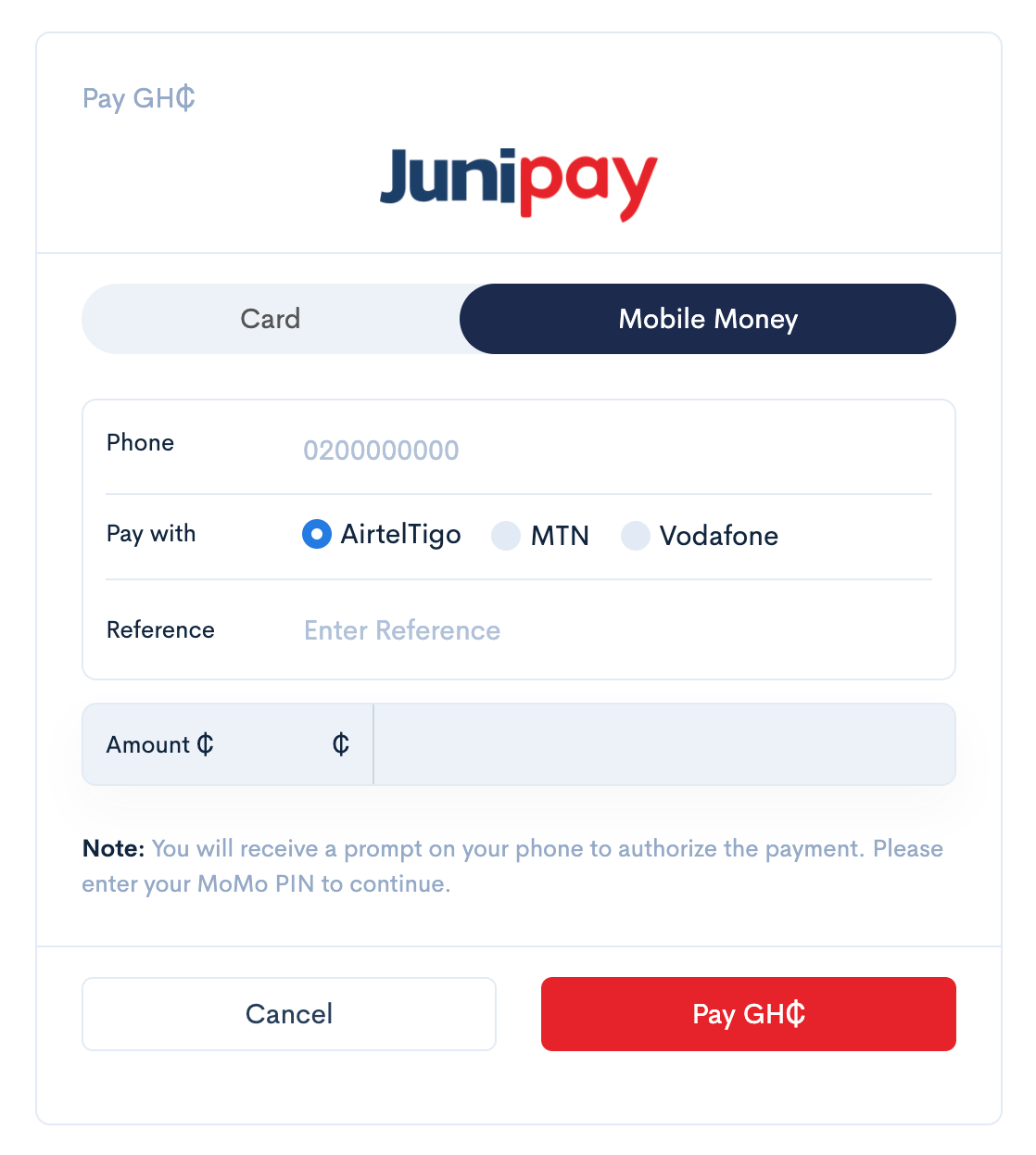

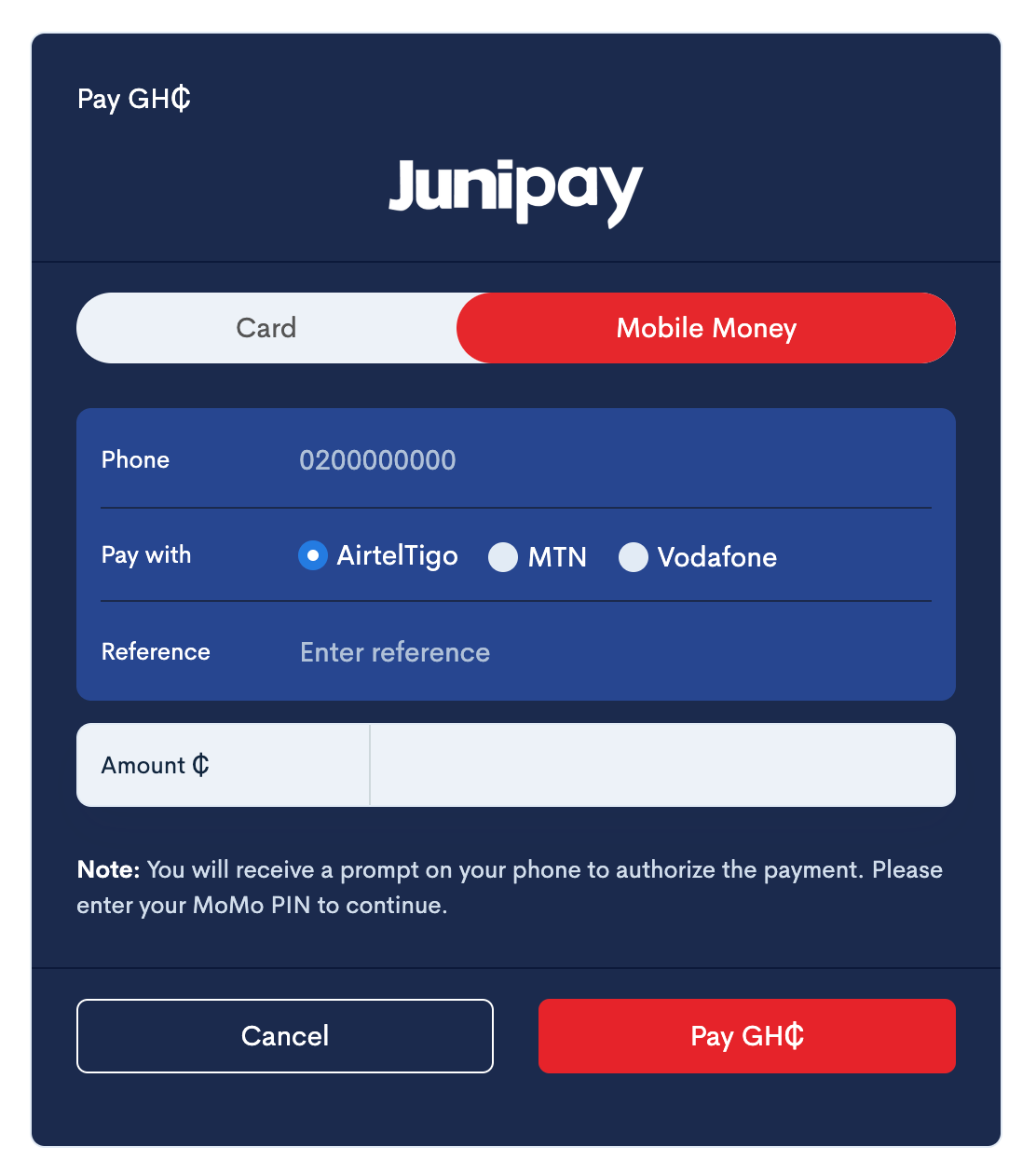

Payment Form Color Variations

White

Blue

Red

Collections API

/payment

Prerequisites

- You must be verified by going through compliance and get approved.

- You must request and be approved to use Direct Access APIs.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

The Collections API allows you to easily receive money with your integration. This API endpoint was created mainly for aggregators and users will have to be approved to use it.

Tokens are required to be generated and defined in the headers parameter for that request to be

authorized.

Tokens must be generated from private keys with the RS256 algorithm and are defined

in the request paramters.

The example below shows how a token is generated

from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Paramter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Paramter | Type | Description |

|---|---|---|

| channel | String | Payment method to be used to collect money from payer mobile_money or card |

| phoneNumber (required for mobile_money channel) | String | Customer's phone number |

| provider (required for mobile_money channel) | String | Customer's phone network provider |

| amount | Double | Amount to transfer in Cedis |

| tot_amnt | Double | Total amount to transfer in Cedis |

| senderEmail | String | Payer's email address. Receipt will be sent to this email when transaction is done. |

| description | String | Transaction description |

| foreignID | String | Unique string that will be used to query a specific transaction |

| callbackUrl | String | URL the callback request will be sent to

Must be of method |

/payment

curl -X POST \

https://api.junipayments.com/payment \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

-H 'content-type: application/json' \

-d '{

amount: '0.1',

tot_amnt: '0.1',

provider: 'mtn',

phoneNumber: '0240000000',

channel:'mobile_money'

senderEmail:'payer@email.com',

description: 'test payment'

foreignID: '132222223'

"callbackUrl": "https://yoururl/callbackUrl"

}'

var http = require("https");

var options = {

"method": "POST",

"hostname": "https://api.junipayments.com",

"port": "3000",

"path": "/payment",

"headers": {

"content-type": "application/json",

"authorization": "Bearer TOKEN",

"clientid": "You Client ID",

}

};

var req = http.request(options, function (res) {

var chunks = [];

res.on("data", function (chunk) {

chunks.push(chunk);

});

res.on("end", function () {

var body = Buffer.concat(chunks);

});

});

req.write(JSON.stringify({

amount: '0.1',

tot_amnt: '0.1',

provider: 'mtn',

phoneNumber: '0240000000',

channel:'mobile_money',

senderEmail:'payer@email.com',

description: 'test payment'

foreignID: '132222223',

"callbackUrl": 'https://yoururl/callbackUrl',

},

json: true

}));

req.end();

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/payment');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'clientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody('{

amount: '0.1',

tot_amnt: '0.1',

provider: 'mtn',

phoneNumber: '0240000000',

channel:'mobile_money',

senderEmail:'payer@email.com',

description: 'test payment'

foreignID: '132222223' ,

callbackUrl: 'https://yoururl/callbackUrl',

json: true

}

');

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Your account will be deducted

The easiest way to try JuniPay is to make a live payment. Choose a small amount that you can afford to give away. Please note that this is a real transaction, and that your account will be debited.

Transaction Status Check API

Verify the status for transactions initiated.

/checktranstatus

Prerequisites

- You must be verified by going through compliance and get approved.

- You must request and be approved to use Direct Access APIs.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

This API enables you to check the status of previously initiated transactions.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Parameter | Type | Description |

|---|---|---|

| transID | String | Unique transaction id to be used to query transaction status |

/checktranstatus

curl -X POST \

https://api.junipayments.com/checktranstatus \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

-H 'content-type: application/json' \

-d '{"transID":"1644578865354"}'

var http = require("https");

const params = JSON.stringify({

transID: '1644578865398'

})

var options = {

"method": "POST",

"hostname": "https://api.junipayments.com",

"port": "3000",

"path": "/checktranstatus",

"headers": {

"content-type": "application/json",

"authorization": "Bearer TOKEN"

"clientid": "Your Client ID"

}

};

var req = http.request(options, function (res) {

var chunks = [];

res.on("data", function (chunk) {

chunks.push(chunk);

});

res.on("end", function () {

var body = Buffer.concat(chunks);

console.log(body.toString());

});

});

req.write(params);

req.end();

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/checktranstatus');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'cientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody(

'{ "transID": "1644578865398"}'

);

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Disbursements

To send money to people using the Junipay API users will go through a number of processes and make use of a number of API endpoints.

Verify Accounts API

/resolve

Prerequisites

- You must be verified by going through compliance and get approved.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

This API allows you to verify a phone number or account number of a recipient before creation or transfer.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

URL Query Parameters

| Parameter | Type | Description |

|---|---|---|

| channel | String | Channel, either mobile_money or

bank

|

| phoneNumber (required for mobile_money channel) | String | Phone number to be verified |

| provider (required for mobile_money channel) | String | network provider of the Phone number to be verified

mtn, vodafone, airteltigo

|

| account_number (required for bank channel) | String | Customer account number |

| bank_code (required for bank channel) | String | Customer's bank code |

/resolve

curl -X GET \

https://api.junipayments.com/resolve?channel=mobile_money&phoneNumber=0248813184&provider=mtn \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

var request = require("request");

var options = { method: 'GET',

url: 'https://api.junipayments.com/resolve',

qs:

{ channel: 'mobile_money',

phoneNumber: '0240000000',

provider: 'mtn' },

headers:

{

'cache-control': 'no-cache',

'authorization': 'Bearer TOKEN',

'clientid': 'Your Client ID'

} };

request(options, function (error, response, body) {

if (error) throw new Error(error);

console.log(body);

});

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/resolve');

$request->setMethod(HTTP_METH_GET);

$request->setQueryData(array(

'channel' => 'mobile_money',

'phoneNumber' => '0240000000',

'provider' => 'mtn'

));

$request->setHeaders(array(

'cache-control' => 'no-cache',

'authorization' => 'Bearer TOKEN'

'clientid' => 'Your Client ID'

));

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Create Transfers Recipient API

/customer

This API allows you to create the recipients of money transferred using the Junipay Disbursement API.

Prerequisites

- You must be verified by going through compliance and get approved.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

Verify first

You are advised to run the verify (resolve) endpoint to ensure the validity of the phone number or bank account number for the transfer recipients to be created.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Parameter | Type | Description |

|---|---|---|

| useremail | String | Customer's email |

| first_name | String | Customer's first name |

| last_name | String | Customer's last name |

| phoneNumber (optional) | String | Customer's phone number |

| provider (required for phoneNumber) | String | Customer's phone network provider |

| account_number (optional) | String | Customer account number |

| bank_code (required for account_number) | String | Customer's bank code |

| callbackUrl | String | URL the response will be sent to |

/customer

curl -X POST \

https://api.junipayments.com/customer \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

-H 'content-type: application/json' \

-d '{"useremail":"johndoe@example.com",

"first_name":"John",

"last_name":"Doe",

"account_number":"0158020000000",

"bank_code":"300328"}'

var http = require("https");

const params = JSON.stringify({

useremail: 'johndoe@example.com',

first_name: 'John',

account_number: '0158020000000',

bank_code: '300328'

})

var options = {

"method": "POST",

"hostname": "https://api.junipayments.com",

"port": "3000",

"path": "/customer",

"headers": {

"content-type": "application/json",

"authorization": "Bearer TOKEN"

"clientid": "Your Client ID"

}

};

var req = http.request(options, function (res) {

var chunks = [];

res.on("data", function (chunk) {

chunks.push(chunk);

});

res.on("end", function () {

var body = Buffer.concat(chunks);

console.log(body.toString());

});

});

req.write(params);

req.end();

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/customer');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'cientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody(

'{ "useremail": "johndoe@example.com",

"first_name": "John",

"last_name": "Doe",

"account_number": "0158020000000",

"bank_code":"300328"}'

);

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Disbursements API

/transfer

Prerequisites

- You must be verified by going through compliance and get approved.

- You must request and be approved to use Direct Access APIs.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

The Disbursement API allows you to easily send money to Bank accounts or Mobile Money with your integration

Verify first

You are advised to run the verify (resolve) endpoint to ensure the validity of the phone number or bank account number for the transfer recipients to be created.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Parameter | Type | Description |

|---|---|---|

| channel | String | Channel to transfer money to, either mobile_money or bank |

| phoneNumber (required for mobile_money channel) | String | Customer's phone number |

| provider (required for mobile_money channel) | String | Customer's phone network provider |

| account_number (required for bank channel) | String | Customer account number |

| bank_code (required for bank channel) | String | Customer's bank code |

| receiver_phone | String | Recipients phone number |

| amount | Double | Amount to transfer in Cedis |

| sender | String | Name of the sender |

| receiver | String | Name of the receiver |

| narration | String | The reason for the transfer |

| foreignID | String | Unique string that will be used to query a specific transaction |

| callbackUrl | String | URL the callback request will be sent to

Must be of method |

/transfer

curl -X POST \

https://api.junipayments.com/transfer \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

-H 'content-type: application/json' \

-d '{

"channel": "bank",

"bank_code": "2001",

"amount": "1",

"account_number": "0000000000000",

"foreignID": "23432200282",

"sender": "Amina Atta",

"receiver": "John Doe"

"callbackUrl": "https://yoururl/callbackUrl",

}'

var http = require("https");

var options = {

"method": "POST",

"hostname": "https://api.junipayments.com",

"port": "3000",

"path": "/transfer",

"headers": {

"content-type": "application/json",

"authorization": "Bearer TOKEN"

"clientid": "Your Client ID"

}

};

var req = http.request(options, function (res) {

var chunks = [];

res.on("data", function (chunk) {

chunks.push(chunk);

});

res.on("end", function () {

var body = Buffer.concat(chunks);

console.log(body.toString());

});

});

req.write(JSON.stringify({

channel: 'bank',

bank_code: '2001',

amount: '1',

account_number: '0000000000000',

foreignID: '23432200282',

sender: 'John Doe',

receiver: 'Amina Atta'

callbackUrl: 'https://yoururl/callbackUrl',

}));

req.end();

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/transfer');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'clientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody(

'{"channel": "bank",

"bank_code": "2001",

"amount": "1",

"account_number": "0000000000000",

"foreignID": "23432200282",

"sender": "John Doe",

"receiver": "Amina Atta"}'

"callbackUrl": "youcallbackUrl",

);

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Remittance

Verify Beneficiaries API

/resolve

Prerequisites

- You must be verified by going through compliance and get approved.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

This API allows you to verify a phone number or account number of a remittance beneficiary.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

URL Query Parameters

| Parameter | Type | Description |

|---|---|---|

| channel | String | Channel, either mobile_money or

bank

|

| phoneNumber (required for mobile_money channel) | String | Phone number to be verified |

| provider (required for mobile_money channel) | String | Network provider of the Phone number to be verified

mtn, vodafone, airteltigo

|

| account_number (required for bank channel) | String | Customer's bank account number |

| bank_code (required for bank channel) | String | Customer's bank code |

/resolve

curl -X GET \

https://api.junipayments.com/resolve?channel=mobile_money&phoneNumber=0248813184&provider=mtn \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

var request = require("request");

var options = { method: 'GET',

url: 'https://api.junipayments.com/resolve',

qs:

{ channel: 'mobile_money',

phoneNumber: '0240000000',

provider: 'mtn' },

headers:

{

'cache-control': 'no-cache',

'authorization': 'Bearer TOKEN',

'clientid': 'Your Client ID'

} };

request(options, function (error, response, body) {

if (error) throw new Error(error);

console.log(body);

});

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/resolve');

$request->setMethod(HTTP_METH_GET);

$request->setQueryData(array(

'channel' => 'mobile_money',

'phoneNumber' => '0240000000',

'provider' => 'mtn'

));

$request->setHeaders(array(

'cache-control' => 'no-cache',

'authorization' => 'Bearer TOKEN'

'clientid' => 'Your Client ID'

));

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Remittance API

/sendremittance

Prerequisites

- You must be verified by going through compliance and get approved.

- You must request and be approved to use Direct Access APIs.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

This API serves as the primary gateway to facilitate money transfers across the world through JuniPay's platform.

Verify first

You are advised to run the verify (resolve) endpoint to ensure the validity of the phone number or bank account number for the transfer recipients to be created.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Parameter | Type | Description |

|---|---|---|

| sender_firstName | String | First Name of the sender |

| sender_lastName | String | Last name of sender |

| sender_email | String | Email of the sender |

| sender_address | String | Address of sender |

| sender_dob | String | Date of birth of sender |

| sender_country | String | Country of sender |

| channel | String | Chanel to transfer money to, either mobile_money or bank |

| sendAmount | Double | Amount to be sent, in Cedis |

| desc | String | Reason for sending Remittance |

| rec_fullName | String | Full name of receiver |

| rec_phoneNumber | String | Phone number of receiver if channel

is mobile_money |

| rec_provider | String | Provider of receiver if channel is

mobile_money

|

| rec_bankNumber | String | Bank account number of receiver if channel is bank |

| rec_bankCode | String | Bank code of receiver if channel is

bank

|

| rec_city | String | City of the receiver |

| rec_relationship | String | Sender's relationship with the receiver |

| foreignID | String | Unique string that will be used to query a specific transaction |

sendingCurrency

new!

|

String | 3 Digit ISO Currency code for the sending currency

eg. USD, GBP

|

receivingCurrency

new!

|

String | 3 Digit ISO Currency code for the receiving currency

eg. GHS, INR

|

sendAmountForeign

new!

|

String | Amount to be sent, in sending currency |

exchangeRate

new!

|

String | Exchange rate used in transaction |

| callbackUrl | String | URL the callback request will be sent to

Must be of method |

/sendremittance

curl --location --request POST 'https://api.junipayments.com/sendremittance' \

--H 'content-type: application/json' \

--H 'authorization: Bearer TOKEN' \

--H 'clientid: Your Client ID' \

--d '{

"sender_firstName": "John",

"sender_lastName": "Doe",

"sender_email": "sender@example.com",

"sender_address": "Maryland, US",

"sender_dob": "1990-01-01",

"sender_country": "USA",

"channel": "mobile_money",

"sendAmount": 1,

"desc": "Miscellaneous"

"rec_provider": "mtn",

"rec_phoneNumber": "0200000000",

"rec_fullName": "Jane Black",

"rec_city": "Accra",

"rec_relationship": "Brother",

"callbackUrl": "https://yoururl/callbackUrl"

}

var unirest = require("unirest");

var req = unirest("POST", "https://api.junipayments.com/sendremittance");

req.headers({

"cache-control": "no-cache",

"authorization": "Bearer TOKEN",

"clientid": "Your Client ID",

"content-type": "application/json"

});

req.type("json");

req.send({

"sender_firstName": "John",

"sender_lastName": "Doe",

"sender_email": "sender@example.com",

"sender_country": "USA",

"channel": "mobile_money",

"sendAmount": 1`,

"reason": "Miscellaneous",

"rec_provider": "mtn",

"rec_phoneNumber": "0200000000",

"rec_fullName": "Jane Black",

"callbackUrl": 'https://yoururl/callbackUrl',

});

req.end(function (res) {

if (res.error) throw new Error(res.error);

console.log(res.body);

});

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/sendremittance');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'clientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody(

"sender_firstName": "John",

"sender_lastName": "Doe",

"sender_email": "sender@example.com",

"sender_country": "USA",

"channel": "mobile_money",

"sendAmount": 1,

"reason": "Miscellaneous"'

"rec_provider": "mtn",

"rec_phoneNumber": "0200000000",

"rec_fullName": "Jane Black",

"callbackUrl": 'https://yoururl/callbackUrl',

);

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}

Transaction Status Check API

Verify the status for transactions initiated.

/checkremittancestatus

Prerequisites

- You must be verified by going through compliance and get approved.

- You must request and be approved to use Direct Access APIs.

- Your private and public key which has to be generated on the Getting Started page on your Dashboard.

- A package to generate your token from your private key. eg.

jsonwebtoken

This API enables you to check the status of previously initiated transactions.

Tokens are required to be generated and defined in the headers parameter for that request to be authorized. Tokens are generated from private keys and are defined in the request paramters. The example shows how a token is generated from a private key using the jsonwebtoken npm package in NodeJS.

// Import the jsonwebtoken packge into your project

var jwt = require("jsonwebtoken");

// Get your private key

var privateKey = fs.readFileSync('{private_key_file_location}');

// Generate token

var token;

try{

token = await jwt.sign({ payload : 'payload_example' }, privateKey, { algorithm: 'RS256'});

} catch(err){

throw err;

}

// Return token

return token;

Header Parameters

| Parameter | Type | Description |

|---|---|---|

| Authorization | String | Set value to

|

| clientid | String | Set value to

|

| Content-Type | String | Set value to

|

Body Parameters

| Parameter | Type | Description |

|---|---|---|

| trans_id | String | Unique transaction id to be used to query transaction status |

/checkremittancestatus

curl -X POST \

https://api.junipayments.com/checkremittancestatus \

-H 'authorization: Bearer TOKEN' \

-H 'clientid: Your Client ID' \

-H 'content-type: application/json' \

-d '{"trans_id":"1644578865354"}'

var http = require("https");

const params = JSON.stringify({

trans_id: '1644578865398'

})

var options = {

"method": "POST",

"hostname": "https://api.junipayments.com",

"port": "3000",

"path": "/checkremittancestatus",

"headers": {

"content-type": "application/json",

"authorization": "Bearer TOKEN"

"clientid": "Your Client ID"

}

};

var req = http.request(options, function (res) {

var chunks = [];

res.on("data", function (chunk) {

chunks.push(chunk);

});

res.on("end", function () {

var body = Buffer.concat(chunks);

console.log(body.toString());

});

});

req.write(params);

req.end();

$request = new HttpRequest();

$request->setUrl('https://api.junipayments.com/checkremittancestatus');

$request->setMethod(HTTP_METH_POST);

$request->setHeaders(array(

'authorization' => 'Bearer TOKEN',

'cientid' => 'Your Client ID',

'content-type' => 'application/json'

));

$request->setBody(

'{ "trans_id": "1644578865398"}'

);

try {

$response = $request->send();

echo $response->getBody();

} catch (HttpException $ex) {

echo $ex;

}